Rates

Finance your vehicle, home improvements, or consolidate credit card debt with auto, home equity, or signature loans.

Learn More

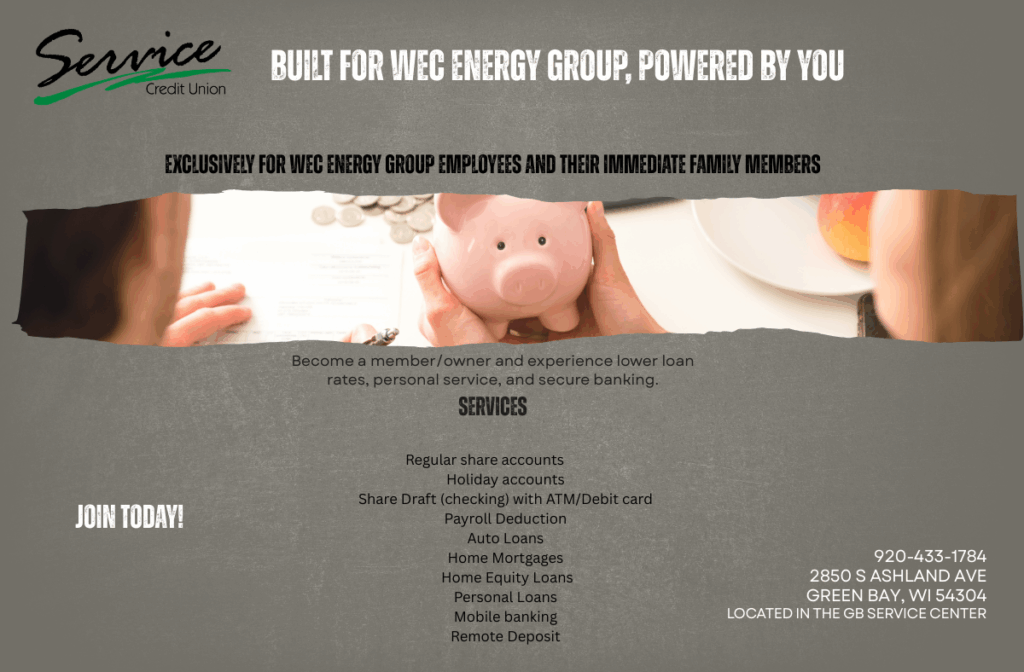

Who Can Be A Member

We exclusively serve any employee or retiree of the WEC Energy Group, its subsidiaries and affiliates, residing in the State of Wisconsin or Michigan. Immediate family members are also eligible.

Learn More

Apply for a mortgage

Service Credit Union has partnered with AmeriCU Mortgage to ensure that all of your mortgage needs are covered.

Learn More

2025 Tax Tip: No tax on car loan interest – for loans on NEW made-in-America vehicles

Use online banking alerts to avoid overdrafts

ISL Student Loans

Finance your new or used vehicle here with rates as low as 4.74% APR*

Check your credit report

Ask for cash back

We have a new Mobile banking app

Finance your vehicle for up to 84 months!

Please sign up for eStatements!

SCU now offers rate matching

SCU Home Mortgages

Remote Deposit with our Mobile App

Service Credit Union Membership

SCU checking account!

Estate planning

Website Accessibility Statement

Service Credit Union is committed to providing a website that is accessible to the widest possible audience, regardless of technology or ability. We are actively working to increase the accessibility and usability of our website and in doing so adhere to many of the available standards and guidelines.

This website strives to conform to level Double-A of the World Wide Web Consortium (W3C) Web Content Accessibility Guidelines 2.0. These guidelines explain how to make website content more accessible for people with disabilities. Conformance with these guidelines will help make the website more user friendly for all people.

While Service Credit Union strives to adhere to the accepted guidelines and standards for accessibility and usability, it is not always possible to do so in all areas of the website.

We are continually seeking out solutions that will bring all areas of the site up to the same level of overall web accessibility. In the meantime, should you experience any difficulty in accessing Service Credit Union’s website, please don’t hesitate to contact us.